Market State Detector

Built for calm AND crisis.

Rules-based market stress classification delivered by 07:30 AM ET every U.S. trading day. Validated (2012–2024).

Stop bleeding premium

Most days are Calm. Aggressive hedging during these regimes has historically created premium drag.

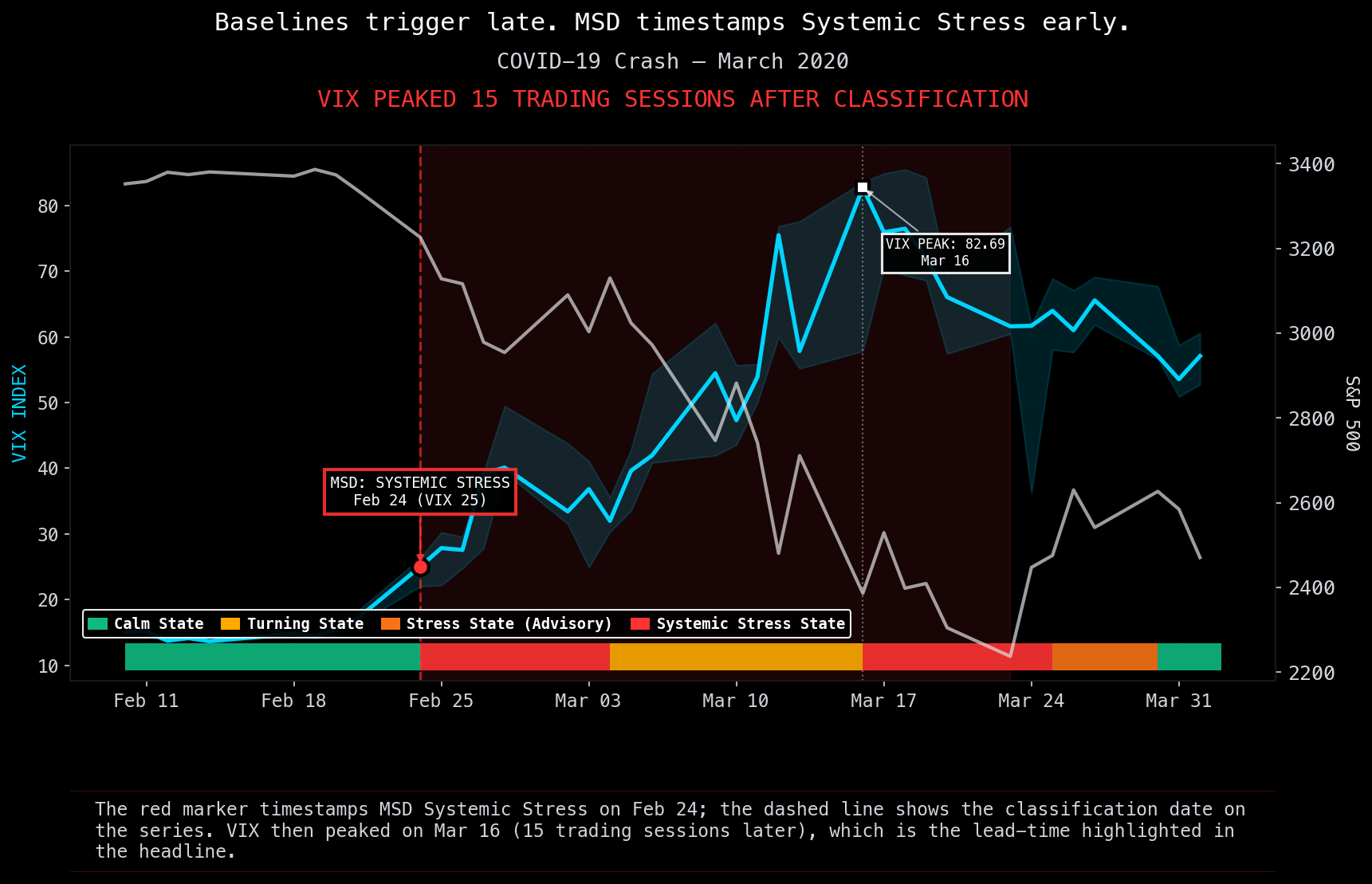

Flag stress before it cascades

Systemic Stress states have historically preceded major market stress episodes with documented precision (100.00%).

Aug 2024

COVID 2020

Apr 2025

Research Briefs

The Calm Dividend

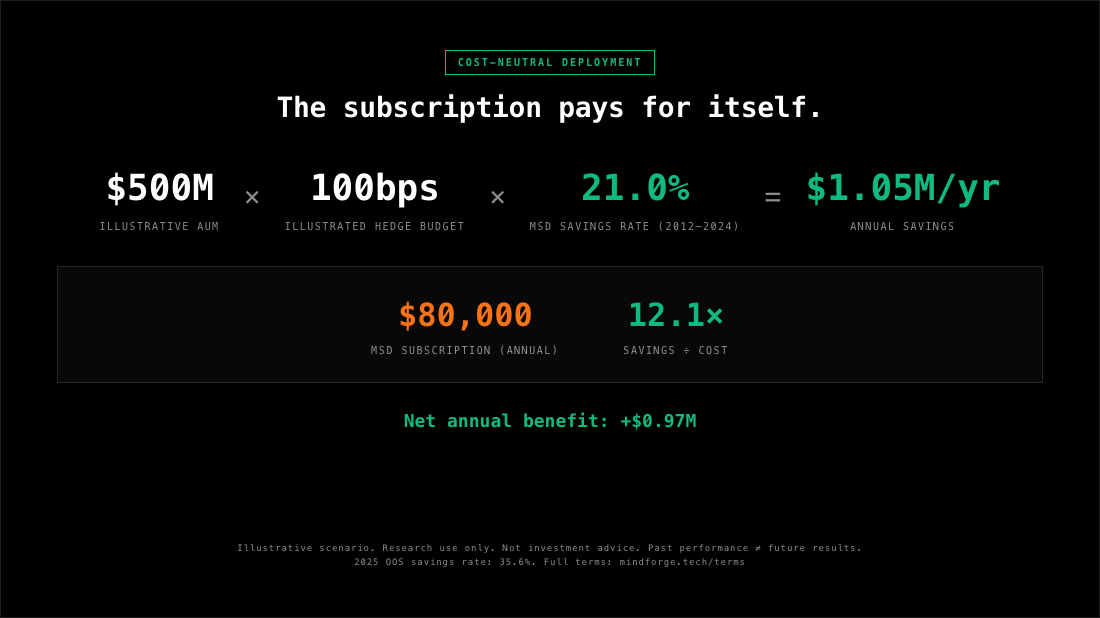

- •12-year backtest (2012–2024) + 2025 OOS

- •~21.0% hedge budget savings (illustrative; historical backtest)

- •VIX-based sizing methodology

Crisis Classification Brief

- •Systemic Stress precision: 100.00% (9/9 episodes)

- •COVID 2020, Aug 2024, Apr 2025 case studies

- •Lead time analysis + methodology

Most Days Are Calm

71% of trading days are classified as Calm State. That's when aggressive hedging bleeds premium. (2012-2024 backtest)

The Calm Dividend: On days classified Calm, historical data shows stable, low-volatility conditions.

Institutional teams can analyze whether reducing hedge intensity during these regimes improves net returns.

Backtested Calm-state hedge savings (~21%/yr baseline; 35.6% in 2025 OOS) can offset subscription cost. Stress detection adds per-event mitigation value.

Signals Ahead of the Break

// CRITICAL DISCLOSURE: HISTORICAL BACKTEST DATA ONLY. NOT INVESTMENT ADVICE.

August 2024 Flash Crash

While traditional VIX-based alerts remained quiet (VIX <30), MSD flagged conditions historically associated with systemic stress before the weekend.

Risk teams with early classification had time to assess carry-trade exposure and review de-risking playbooks before Monday's open.

Traditional indicators triggered only after portfolios were impaired. MSD provided informational context 1 trading day earlier.

MSD is Running Now

The system classifies every U.S. trading day. Here's a delayed state example (current subscribers receive today's classification by 07:30 ET).

Historical classification shown. Research use only.

Why Teams Choose MSD

A Research Input for Morning RiskMorning Risk Input

Rules-based market state classification delivered pre-market. Built for scenario planning and governance workflows.

Standardized morning read

A standardized alternative to ad hoc dashboards and PM-by-PM judgment calls.

Research-grade classification

Rules-based system combining environmental and market data. Historical lead times documented for each state.

Audit-ready history

12+ years of timestamped daily states. Replayable for reviews, board packs, and client communication.

Research use only. Not investment advice. Terms

Five States of Market Stress

Proprietary rules-based classification framework providing daily informational context for institutional risk regimes.

Systemic Stress State

CRITICALUltra-selective classification for crisis-level market stress conditions.

Volatility Spike State

SEVEREClassification for rapid volatility surge conditions.

Stress State (Advisory)

ADVISORYResearch-grade classification for moderate stress conditions.

Turning State

INFLECTIONClassification for potential regime shift and exhaustion points.

Calm State

BASELINEClassification indicating absence of stress across all indicators.

Institutional Access

Lock in $80,000/yr for 3 Years

Early adopter pricing. Limited to the first 10 qualified institutional partners before 2026 rate adjustments. Subject to qualification.

Apply for Partner StatusMonthly

- Billed monthly

- Cancel anytime

- Daily pre-market feed

- Historical dataset

Annual

- Billed annually

- ~$6,667/mo effective

- All Monthly features

- Priority support

- Quarterly reviews

Enterprise

Over $5B AUM or full integration

- Multi-desk deployment

- Firm-wide licensing

- Custom API integration

- Dedicated account manager

Research use only. Not investment advice. Terms